Image source: https://image.slidesharecdn.com/2012overviewmenaprojectpppfinance-13509050091185-phpapp02-121022062831-phpapp02/95/2012-mena-project-and-ppp-finance-60-638.jpg?cb=1360217084

The past few years have brought the bonds world into the high hazard market. Through this time subtle adjustments have occurred to make the process more victorious on the applicants (no collateral-high hazard). Eventually underwriters should still begin to outline a cloudy domain for middle flooring charges for applicants which have poor credit sue to extra minor infractions.

The bonding businesses that settle for high hazard applicants right this moment are very few, though slowly new businesses get up that are prepared to put in writing applicants using an coverage extensively focused philosophy. This upgrade in competitors for the high hazard market is huge for the principle, as this competitors has made charges extra moderate (a little bit) and lowered certain needs such as cash collateral, whilst adding new courses of monetary that are accepted as high hazard.

After a brief a interval of time whereby this used to be the norm, a unhealthy credit rating surety bond programs all began to emerge. These programs have been an substitute for individuals with a unhealthy credit rating that went against straight forward suretyship. In these programs the surety would write for high hazard advertisement (sorry, this programs do now not monitor to contract bonds), nonetheless at most top charges then commonplace bonds. Though this solution might well also have seamed very glaring to many, it might well be famous that straight forward surety underwriting is done with a nil% loss ratio. What this method is that unlike coverage, which many parents mistake surety bonds for, there is no loss built into the prime class of the bonds, hence only one of the prime applicants traditionally are accepted.

The truth of the matter is that many Americans should still now not have desirable credit, or anywhere with reference to for that matter. One examine (http://www.nationalscoreindex.com/ScoreNews_Archive_03.aspx) by Experian suggests that the credit of a commonplace American is 683. With a bond market that recurrently looks for a credit rating of 650 or better, an outsized amount of the market used to be regarded as "un-bondable". Typically individuals with sub-par credit rating would ought to get an Irrevocable Letter of Credit from the bank, or acquire a bond by posting one hundred% collateral.

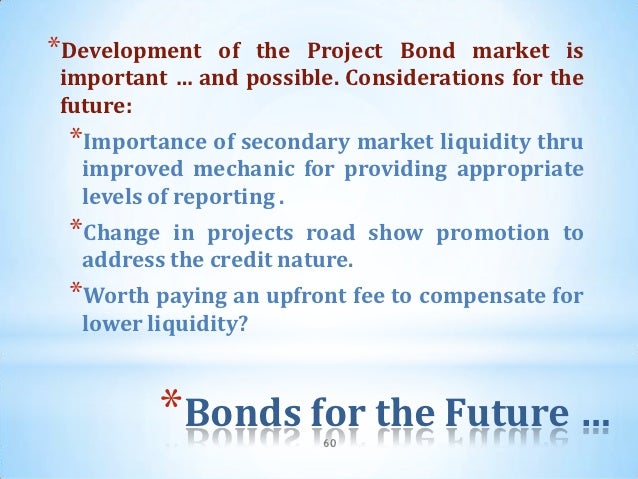

So whereby does the future lie? This is most probably the very unlikely question since very few would have predicted these High Risk Bonds from ever happening. Though many applicants might well also wish for lower expense, this does now not appear like throughout the playing cards as explained above throughout the 0% loss ratio mentality. The Bond market is particularly transparent, it is separated into two camps, you are either throughout the atypical market, or you are high hazard. One element which can well also occur throughout the future with improved competitors is a scale of the high hazard market. Perhaps those applicants with a history of a total lot of collections might well also receive charges throughout the 8% -10% degrees, in prefer to merely being lumped with applicants which have bankruptcies on their credit history.